Swiss Prime Site Solutions Investment Fund Commercial

The Swiss Prime Site Solutions Investment Fund Commercial invests directly in commercial properties across the whole of Switzerland. The investment focus is on broad diversification, high cash flow stability and economically established locations. The fund launched on 17 December 2021.

The Swiss Prime Site Solutions Investment Fund Commercial pursues the goal of achieving an attractive, sustainable dividend payment. The investment vehicle is open to private investors and institutional clients and is listed on the SIX.

Investment strategy

The investment focus is on broad diversification, high cash flow stability and economically established locations. The properties mostly fall within the light industrial, retail and office types of use.

Core+

- High-yield commercial properties in economically stable locations in Switzerland

- Attractive cash flows with high stability

- High tenant diversification with good credit ratings and reputations

- Mainly sole ownership

- Direct ownership

«With the Investment Fund Commercial, we are offering you an attractive investment in economically established locations with an optimally balanced risk/return profile in customary Swiss Prime Site quality.»

Fund Facts

| Fund name | Swiss Prime Site Solutions Investment Fund Commercial |

| Tradability | Listed on the SIX Swiss Exchange |

| Valor / ISIN | 113 909 906 / CH1139099068 |

| Ticker symbol | IFC |

| Appropriation of income | Distributing |

| Fund Term | Indefinite |

| Legal Form | Contractual real estate fund (public fund) |

| Property | Properties are held directly, which provides a tax advantage for investors subject to taxation |

| Custodian bank | Banque Cantonale Vaudoise |

| Permanent valuation expert | PricewaterhouseCoopers AG, Zurich |

| Portfolio & asset management | Swiss Prime Site Solutions (FINMA regulated) |

| Redemption of fund units | At the end of the financial year subject to a notice period of 12 months |

| Accounting year | 1 October to 30 September |

| Fund currency | CHF |

Corporate calendar

21 May 2026

Semi-annual report as at 31.03.2026

18 November 2026

Annual report as at 30.09.2026

Key figures annual report

(30.09.2025)

Fair value

462.7 mn

Investment yield

6.4%

Cash flow return

5.8%

Net income

17.9 mn

Portfolio

Number of properties

17

Wault

5.4 years

Properties

Sustainability

Our sustainability approach

The fund management pursues the goal of net-zero CO2 of the portfolio by 2050 with regard to heat and electricity supply. The aim is to comply with a CO2 reduction pathway that corresponds to the 1.5 degree target of the Paris Climate Agreement and the net-zero target set by the Swiss Federal Council by 2050.

The fund management company pursues ESG integration as a sustainability approach and strives for a sustainable investment policy. When selecting and managing investments, environmental (E) and social (S) criteria as well as aspects of responsible corporate governance (G), the so-called ESG criteria, are given appropriate consideration in all phases of the property investment process (acquisition of existing properties, project developments, construction, conversion and refurbishment projects, portfolio and asset management).

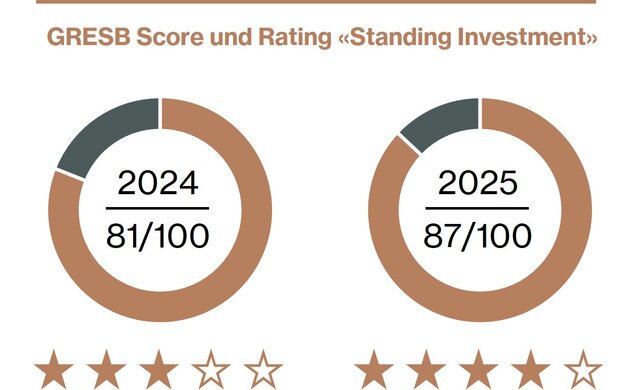

Ratings

Global Real Estate Sustainability Benchmark (GRESB)

We have successfully implemented the GRESB Grace Period submission 2023. We received the first official GRESB assessment in October 2024.

REIDA

The non-profit organisation REIDA (Real Estate Investment Data Association) has developed a standard for determining the most important environmentally relevant key figures in the real estate sector. The "Environmental indicators" for the 2023/2024 financial year were published in accordance with this REIDA standard.

Principles for Responsible Investment (PRI)

In November 2022, Swiss Prime Site Solutions signed the UN Principles for Responsible Investment (UN PRI) for the SPSS IFC and officially reported in accordance with the PRI framework for the first time in 2024. Below you will find the results for 2024.

Downloads

Various documents

Reports

| Semi-annual reports (as at 31.03.) | Annual reports (audited, as at 30.09.) | |

|---|---|---|

| 2025 | 31.03.2025 | 30.09.2025 |

| 2024 | 31.03.2024 | 30.09.2024 |

| 2023 | 31.03.2023 | 30.09.2023 |

| 2022 | 31.03.2022 | 30.09.2022 |

Factsheets

| 31.03. | 30.06. | 30.09. | 31.12. | |

|---|---|---|---|---|

| 2025 | 31.03.2025 | 30.06.25 | 30.09.2025 | |

| 2024 | 31.03.2024 | 30.06.2024 | 30.09.2024 | 31.12.2024 |

| 2023 | 31.03.2023 | 30.06.2023 | 30.09.2023 | 31.12.2023 |

| 2022 | 30.06.2022 | 30.09.2022 | 31.12.2022 |

Subscription service for publications

Subscription service

Downloads in french

Documents divers

Rapports

| Rapports semestriels (au 31.03.) | Rapports annuels (vérifié, au 30.09.) | |

|---|---|---|

| 2025 | 31.03.2025 | |

| 2024 | 31.03.2024 | 30.09.2024 |

| 2023 | 31.03.2023 | 30.09.2023 |

| 2022 | 31.03.2022 | 30.09.2022 |

Fiches d'informations

| 31.03. | 30.06. | 30.09. | 31.12. | |

|---|---|---|---|---|

| 2025 | 31.03.2025 | 30.06.25 | ||

| 2024 | 31.03.2024 | 30.06.2024 | 30.09.2024 | 31.12.2024 |

| 2023 | 31.03.2023 | 30.06.2023 | 30.09.2023 | 31.12.2023 |

| 2022 | 30.06.2022 | 30.09.2022 | 31.12.2022 |

Board of directors

Team

Client Relations

Development & Construction